Top Ideas For Picking RSI Divergence Trading

Wiki Article

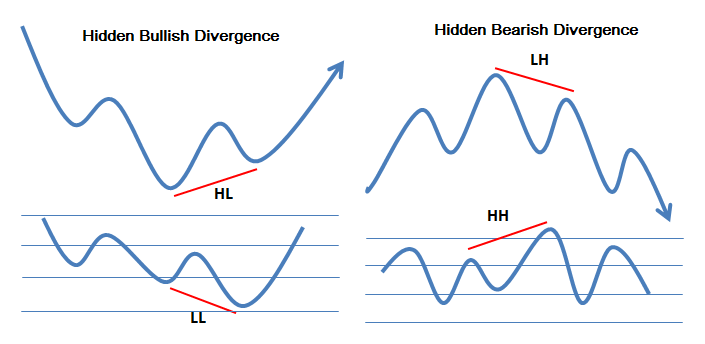

Okay, let's begin with the most obvious question and explore what is RSI Divergence is and what trading indicators we can learn from it.|Okay, let's start with the most obvious question. Let's look into the meaning behind what RSI Divergence means and what trading signals it could give.|Let's begin with the obvious question. We will explore the meaning of RSI Divergence actually is and what insights traders can derive from it.|Let's begin by asking the most obvious question. Let's look at what RSI Divergence really is and what trading signals we can learn from it.|Okay, let's get started by asking the obvious question. Now, let's explore the what RSI Divergence looks like and the trading signals that can be gleaned from it.} When the price action of your chart and the RSI signal are out of the same synchronization, a divergence is likely to be observed. Which mean, in a Downtrend market price makes a lower low, but the RSI indicator has higher lows. In essence, a divergence occurs when the indicator does not match the price movement and when a situation similar to this arises, you should be attentive to the market. The chart clearly shows both bullish RSI divigence and bearish RSI divigence. As such, the price action reversed immediately following each RSI Divergence signal. Let's look at one final issue before we move on to the exciting topic. See the top rated backtesting strategies for website examples including position sizing calculator, backtesting trading strategies, cryptocurrency trading bot, cryptocurrency trading, RSI divergence cheat sheet, crypto trading backtester, crypto backtesting, forex backtesting software free, backtesting strategies, crypto trading bot and more.

How Do You Analyze The Rsi Divergence?

We utilize the RSI indicator to identify trend reversals. It is crucial to identify the right trend reverse. In the beginning, we must have a trending market. We then use RSI divergence to find weak points. Once the information is uncovered and analyzed, we can make use of it to determine the trend reversal.

How To Spot Rsi Divergence When Forex Trading

Both Price Action and RSI indicators both made higher highs towards the beginning of the trend up. This typically indicates that the trend is robust. The trend ended when Price reached higher levels at the conclusion. However, the RSI indicator was able to reach lower highs. This means the chart is worth looking at. In this case, we must pay particular attention to the market, since both the indicator's price action and the indicator are outof the sync. This indicates that there is an RSI divergence. In this case this case, the RSI divergence indicates a bearish trend change. Check out the chart to see what happened following the RSI Divergence. You can see that the RSI divergence is highly accurate when it comes to identifying trend reversals. But the question is, How to actually catch the trend reversal, right? Let's now talk about four practical trade entry techniques that give higher-risk entry signals when paired with RSI divergence. Check out the best cryptocurrency trading bot for blog recommendations including software for automated trading, automated trading software, automated cryptocurrency trading, forex backtester, forex backtest software, backtesting tool, RSI divergence, crypto trading bot, crypto backtesting, trading platform crypto and more.

Tip #1 – Combining RSI Divergence & the Triangle Pattern

Two variants of the triangle chart pattern are accessible. The pattern of the ascending triangle is utilized to reverse a downward trend. The other is the descending triangular pattern, which is used in uptrend markets as an inverse. Take a look below at the descending triangular pattern depicted on the chart of forex. Like the earlier instance, the market was on an upward direction, and after that the price began to decrease. RSI is a signal of divergence too. These indicators indicate the negatives of this trend. We can now see that the current uptrend is losing momentum. In the end, the price has formed an upward triangle. This confirms that there is an upward reversal. It is now time to make the short trade. This trade was made with the same breakout techniques like the first one. We will now examine the third strategy for gaining entry into trades. This time we will be combining trend structure with RSI diversity. Let's see how you can trade RSI divergence when the structure of the trend changes. Check out the recommended forex tester for blog tips including automated trading bot, crypto trading backtesting, automated cryptocurrency trading, automated cryptocurrency trading, forex tester, trading with divergence, best trading platform, backtesting, crypto trading backtesting, backtesting tool and more.

Tip #2 – Combining RSI Divergence with the Head and Shoulders Pattern

RSI divergence helps forex traders to identify market reversals, right? You can increase the likelihood of your trade by combining RSI diversence with other factors that can reverse the market, such as the Head-and-shoulders pattern. Let's look at how we can time our trades by using RSI divergence with the head and shoulder pattern. Related: Trading Head and Shoulders Patterns in Forex: A Reversal Trading Method. Before we can think about a trade entry, it is essential to have a favourable market condition. The markets that are trending are the best as we are seeking a trend reversal. Check out the chart below. Have a look at the top rated backtesting platform for more info including forex backtester, automated forex trading, RSI divergence cheat sheet, trading platform, forex backtesting software free, automated trading, crypto trading backtesting, trading platform cryptocurrency, cryptocurrency trading bot, divergence trading forex and more.

Tip #3 – Combining RSI Divergence with the Trend Structure

Trends are our friends, isn't it! The trades must be made in line with the trend as long the market is trending. This is how professionals teach us. The trend will eventually end, but it won't continue for ever. Let's find out how to spot reversals quickly by studying the structure of the trend and the RSI divergence. We all know that uptrends are forming higher highs while downtrends are forming lower lows. Look at this chart. Now if you look to the left side of this chart, you'll see that it is an downtrend that has a pattern of lows and lower highs. Next, have a look at the RSI divergence marked on the chart (Red Line). Price action is the cause of Lows, but the RSI create higher lows, right? What does this all mean? Even though the market is creating low RSI is the reverse. This indicates that the downtrend that is currently in place is losing momentum. We must be ready for a reversal. See the top backtesting strategies for site recommendations including backtesting platform, backtester, cryptocurrency trading bot, forex backtester, forex trading, backtesting tool, automated crypto trading, automated trading software, automated trading software, trading platform and more.

Tip #4 – Combining Rsi Divergence And The Double Top/Double Bottom

Double tops, also known as double bottom, is a reverse trend that occurs after an extended movement. The double top forms after the price has reached a point that is not easily broken. Once it has reached that point, the price will retrace down a bit, only to return to the previous level again. If the price moves back to this level, there is double top. The double top is below. The double top below illustrates the creation of two tops through a powerful maneuver. Notice how the second highest top didn't reach the heights of the first. This is a sign of an inverse. It's telling investors that they are struggling to keep going higher. The double bottom also uses the same principles but is performed in an opposite direction. Here we will use the breakout entry method. We execute an order to sell when the price falls below the threshold. Within one day, our take-profit attained. QUICK PROFIT. Double bottoms are covered by the same trading strategies. Below is a chart which will show you the best way to trade RSI diversgence with double top.

Keep in mind that this is not the best all-traders strategy. There is no one perfect trading strategy. All trading strategies have losses, and these losses are inevitable. We can earn consistent profits using this strategy, but, we do are able to implement a rigorous risk management system and a quick way to minimize our losses. We are able to reduce the drawdown while also opening up new opportunities for great upside potential.